- Quick Pitch

- Posts

- Stratiphy

Stratiphy

One codebase. Both enterprise and consumer portfolio management

The quicker pitch: Notion

We’ve bagged startups 6 months free of Notion’s Business Plan, plus Notion AI (worth up to $12k in savings).

Apply in 5 questions (we tested it and it took less than a minute).

Use button below or this link: https://ntn.so/quickpitchgrowthhub (the QP code will be pre-filled)

We run QP from Notion so it’s amazing to have them as a partner.

Join us, as well as the 94% of Forbes AI 50 companies and 50% of YC startups who use Notion, to consolidate your tech stack, reduce costs, and collaborate more effectively.

At a glance

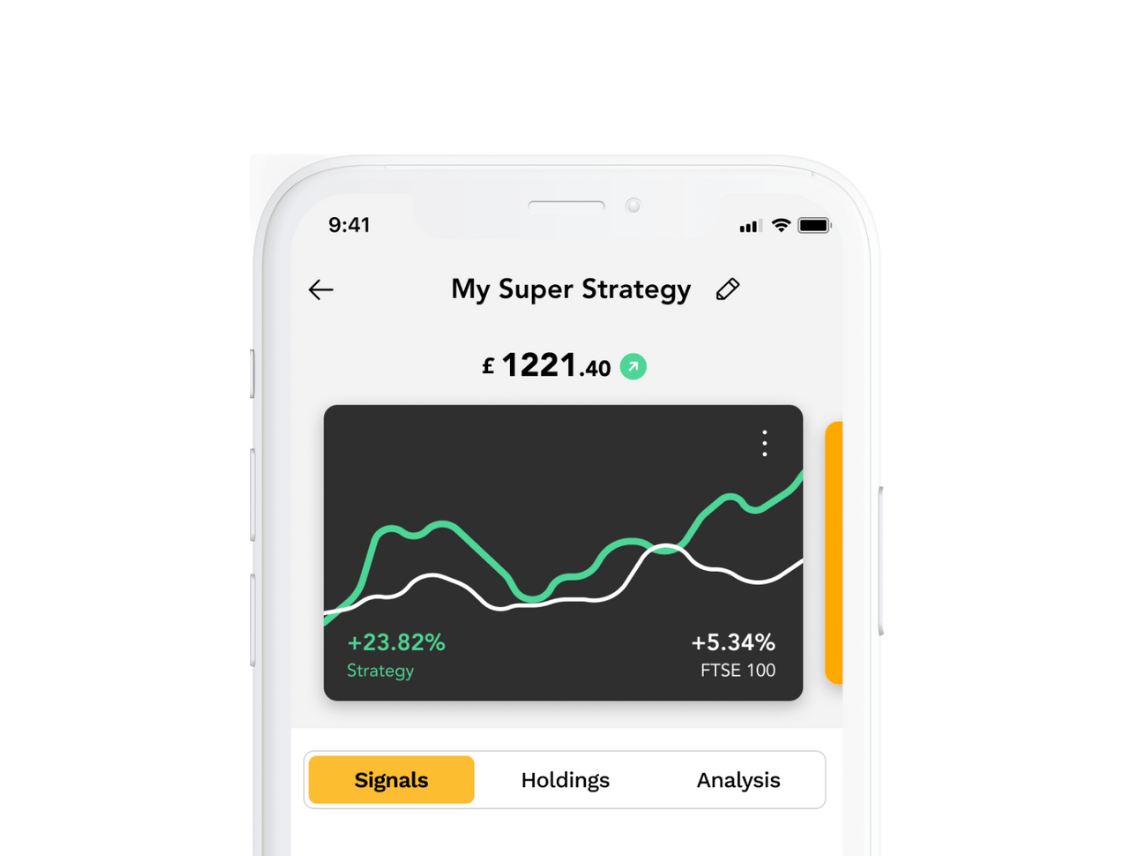

Stratiphy have built one codebase that can serve business clients via API and retail customers directly through their app to provide affordable and accessible portfolio management for everyone.

Asset managers, hedge funds, and banks can personalise their client facing investment services at scale, with a standardised approach to portfolio management.

Subscription-based investment app for personalised investment strategies. Each investor sets their own goals, values and preferences.

Quick fire details

Headquarters: London, UK

Employee count: 10

Business model: B2B and B2C

Backed by: Industry investor interest for £500k and £500k from angels.

S/EIS: ✅

Funding amount: £2,000,000 Seed round

The founders

Cofounder & CEO, Daniel Gold: PhD from Southhampton and prev founded a Jerusalem based solar energy company. After that Daniel worked in finance, mostly derivatives pricing before starting Stratiphy to offer everyday investors the same access to the market that sophisticated investors have. .

Cofounder & Head of Growth, Nikki Hawkes: Exited founder having sold her sports events company where she built the community to over 10,000 to Krono Sports.

The market

The ‘Netflixing’ of wealth management is predicted by “2030, where up to 80% of new clients are expected to access advice in a model that is, data driven, hyper-personalised, self-served, and driven by subscriptions.”

This startup is solving one key problem:

The advice gap: 55% of consumers think financial advie is just for the wealthy. But more people with modest portfolios are struggling

to access personalised solutions.

Organisations like IM’s and advisors are experiencing disruption and are ready to embrace technology driven solutions and underserved consumers.

Founder-Market Fit:

Daniel has a highly technical background in mathematics and programming and has built an advisory team alongside him of top industry executives from companies like Hargreaves & Lansdown, Meryll Lynch and Coutts.

Traction metrics

Obtained direct authorisation from the FCA in April 2024.

Obtained approval as ISA manager by HMRC in November 2024.

5000+ newsletter subs (company updates and feature news)

100 live in-house strategies with customised templates

1000+ app IOS and Android app downloads

3 commercial consortium partners (drafting contracts for three large prospective deals, each with an average return of about £300k/ year)

Competitive landscape

Scalable Capital, Nexus Trade, collidr, Composer, Quantbase, Investengine

Stratiphy has built AI powered portfolios, backed by a secure REST API, that react to the market and optimise customers risk-adjusted performance.

The quicker pitch: Apply to QP

We're growing faster than ever and we want to keep building momentum so we can intro more top founders to top investors.

More startups are applying. And the quality keeps going up.

For the every founder who has subscribed to us recently 👇

This is your chance to get featured in front of 3.5k engaged investors and startup operators. (Btw it’s free).

Our Take

Appeals

Market tailwinds: New UK Consumer Duty regulations mean firms can no longer rely on high fees and generic offerings.

2x markets: Stratiphy have built one codebase that can serve business clients via their off-the-shelf API and retail customers directly via their app at the same time.

First in-class AI-Powered support: Powered by natural language processing, Strativeristy delivers clear, accurate, and jargon-free explanations that users can trust.

Risks

Very competitive industry: Large players who have raised millions and are targeting similar demographics in the same market. Differentiation and trust building is key.

Cost of customer acquisition: Stratiphy need to be laser focussed on building customer trust especially with such high ease to churn.

Keeping on top of UK regulations: Now they’re FCA regulated, staying on top of the regulations especially when growing so quickly is crucial to avoid huge fines and loss of customer trust.

To request an introduction to the founder, choose 'Yes' below |

What do YOU think of Stratiphy?Choose you vote and tell us WHY in the comments |

Last feature’s results

Our readers are BULLISH about Reco HQ.

83.33%of readers are a fan | 16.67%of readers are not convinced |

“Huge fan of what they’re doing here”